In the eye of the mortgage storm

Annual inflation figures for July and August are expected to bring better news for the UK economy as the impact of higher energy costs recedes. But higher than forecast rates reported so far this year and rising core inflation measures are leading forecasters to speculate that base rates will need to increase further and stay higher for longer.

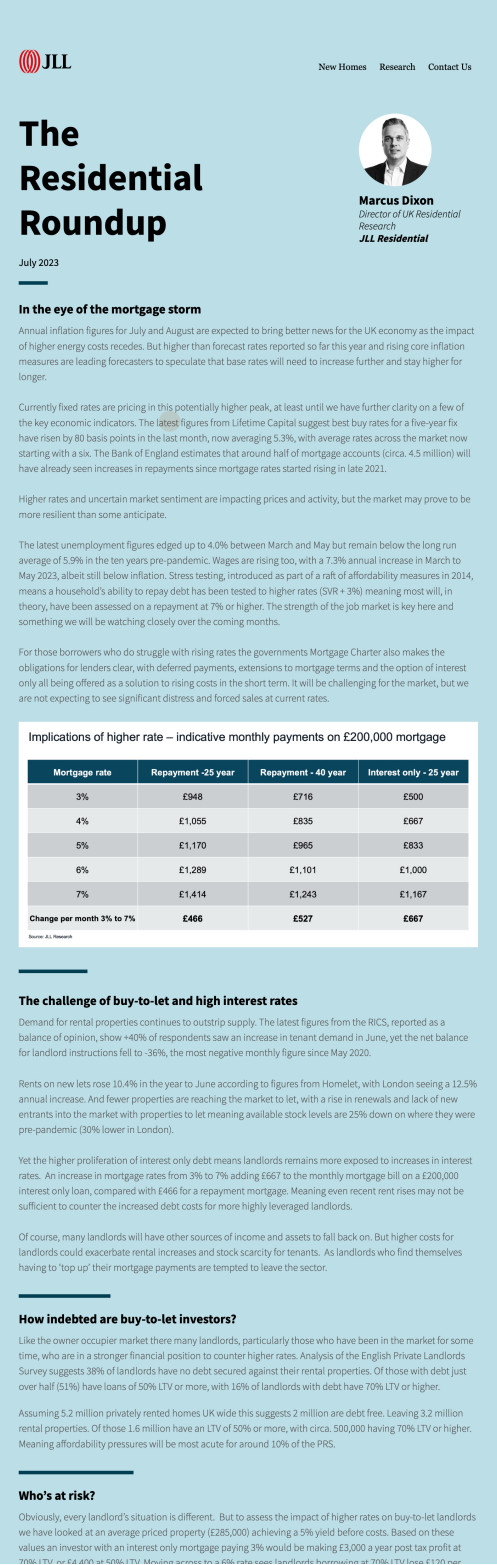

Currently fixed rates are pricing in this potentially higher peak, at least until we have further clarity on a few of the key economic indicators. The latest figures from Lifetime Capital suggest best buy rates for a five-year fix have risen by 80 basis points in the last month, now averaging 5.3%, with average rates across the market now starting with a six. The Bank of England estimates that around half of mortgage accounts (circa. 4.5 million) will have already seen increases in repayments since mortgage rates started rising in late 2021.